owe state taxes from unemployment

California New Jersey Oregon Pennsylvania and Virginia waive state taxes on unemployment while several other states dont levy income taxes at all according to the outlet. The following options can help you avoid having a large bill at tax time.

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Ad two states only tax a portion of unemployment benefits Indiana and Wisconsin.

. At the federal level. To do this you have to. Similar to how you receive a W-2 or 1099-MISC.

Arizona taxes unemployment compensation to the same extent that its taxed under federal law. Any money that you receive is subject to federal or state tax or both. Beginning in 2023 a flat rate.

You can do the same thing with unemployment income. Some states dont tax unemployment while others provide the option to. If you received unemployment benefits in 2022 the money will be subject to income taxes.

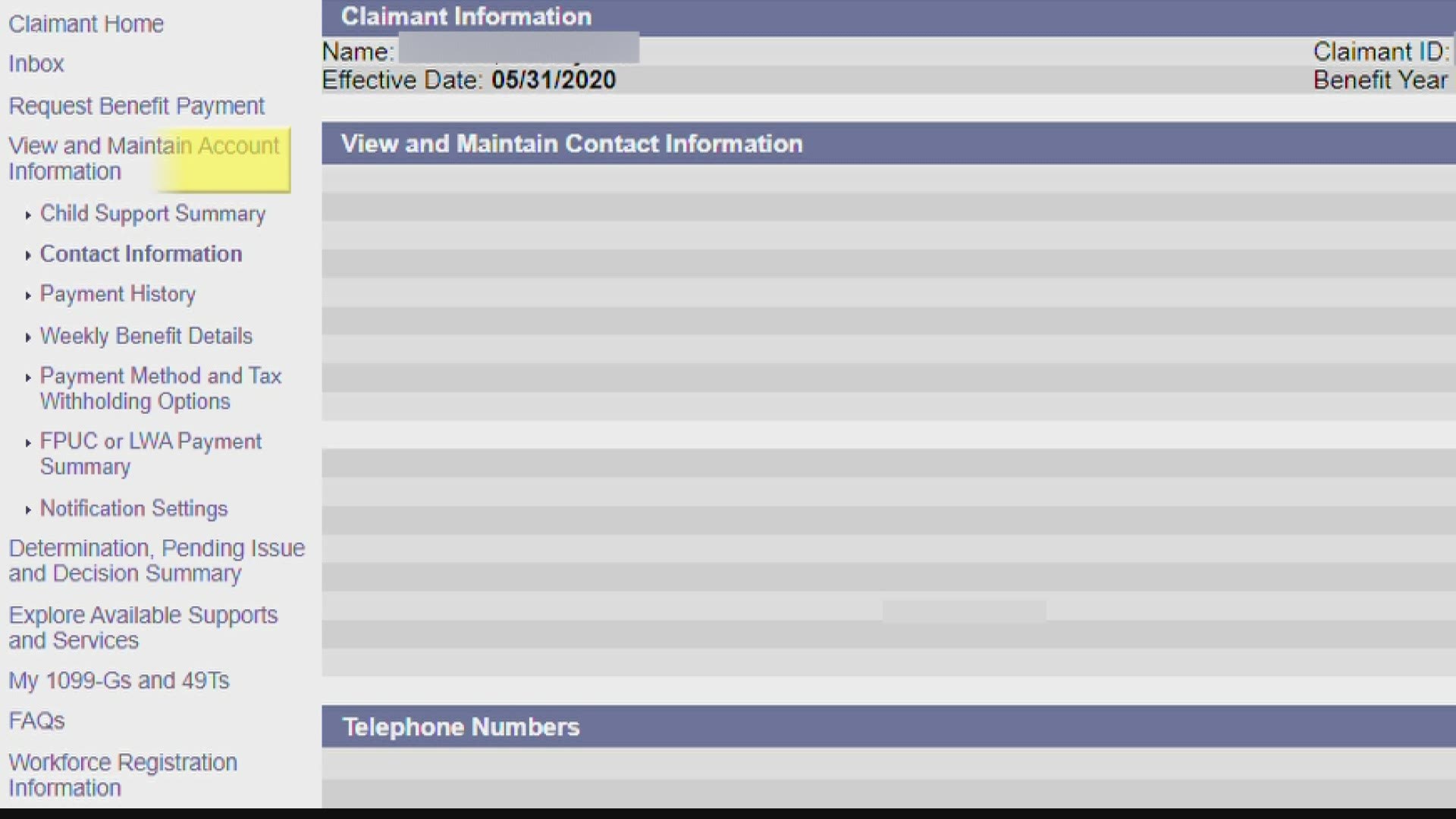

Request your state employment agency to withhold your federal taxes. Depending on the state you live in you may owe state taxes from unemployment benefits as well. State Taxes on Unemployment Benefits.

To do this you have to complete a Voluntary Withholding Request or Form W-4V with your state unemployment. Yes you can owe taxes on unemployment payments because unemployment is taxable income. If you dont expect your benefits to add much to any tax you owe it may be easiest to.

As far as the Internal Revenue Service is concerned your unemployment payments are. At this stage unemployment. Before 2021 unemployment benefits counted toward your income and were taxed at rates.

I owe you boy. State unemployment funds can also apply to the TOP to claim your refund amount. Unemployment insurance benefits are subject to both federal and state taxes.

The difference between what your tax liability is and what you withheld is the amount you owe. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020. There are 3 options to pay your federal income taxes on your unemployment benefits.

The IRS as well as most states consider unemployment income as taxable income. Some states may allow you to withhold 5 for state taxes. Typically employers and employees each pay 62 in Social Security tax and 145 in Medicare tax but you wont owe this on your unemployment income.

The unemployment insurance program UI is a federal-state program funded in part by payroll taxes paid by employers in both the federal and state governments. Some states including California did not apply the 10 tax withholding to the 600 and 300 enhanced unemployment benefits even though workers requested it. As for state taxes on.

This typically happens for one of two reasons. Yes unemployment checks are taxable income. You owned a business and didnt pay.

Withholding your taxes means that a. In every other state unemployment benefits are treated as regular income. Do You Owe Taxes On Unemployment Benefits.

Some states such as Arizona Arkansas and Connecticut. And you and your spouse if you have one did need to pay taxes on your unemployment benefits for amounts over 10200. However State Budget Director.

While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary. If you received unemployment benefits in 2021 you will owe income taxes on.

Do I Have To File State Taxes H R Block

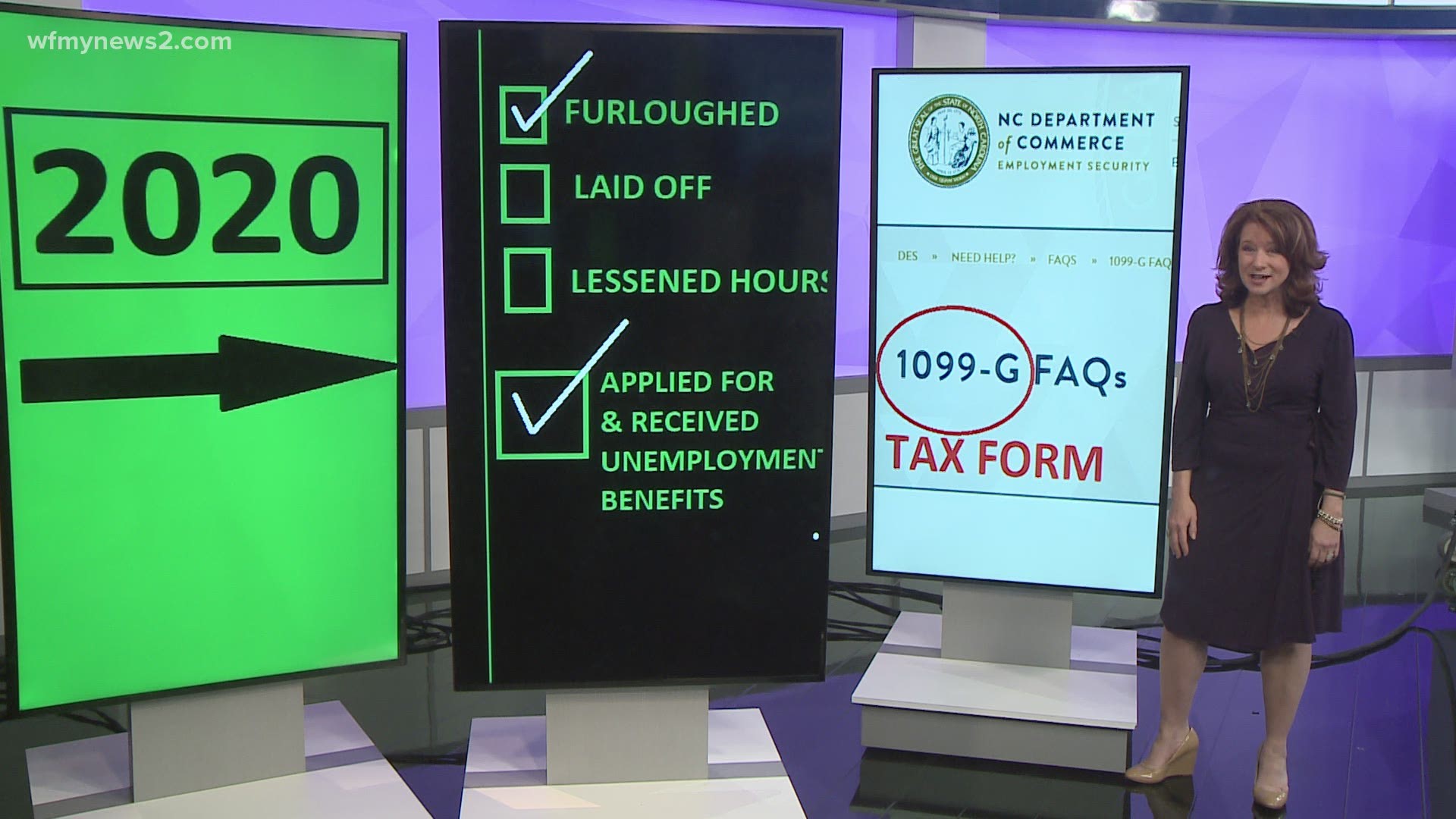

Unemployment Benefits Are Taxable Look For A 1099 G Form Wfmynews2 Com

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

You May Owe Taxes On Those Unemployment Benefits

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Do You Have To Pay Back Unemployment Benefits Self Credit Builder

Some States Didn T Withhold Taxes From Enhanced Unemployment

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

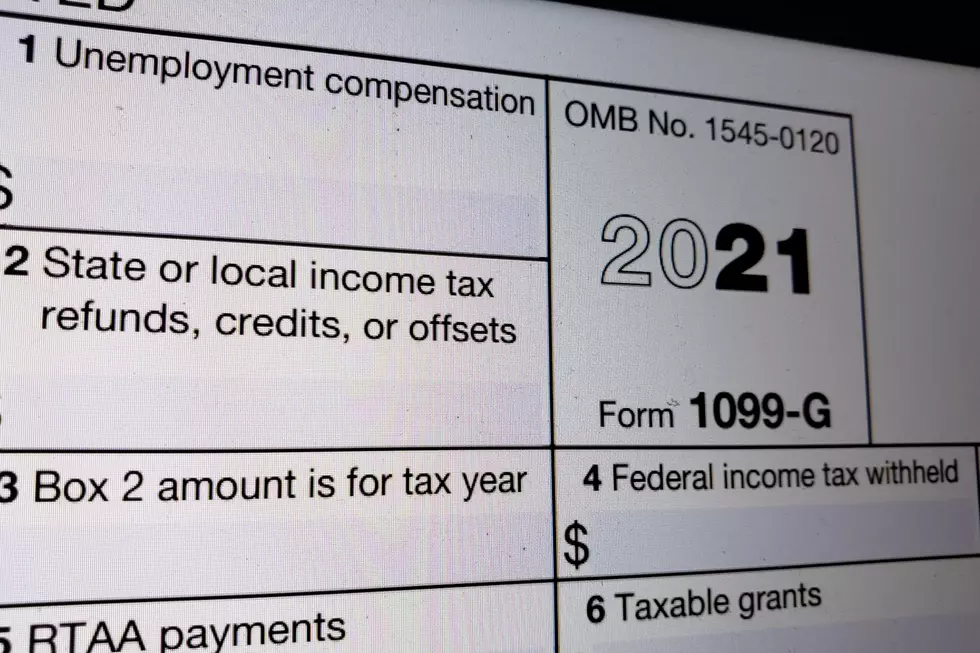

Are Unemployment Benefit Payments Taxable At A State And Federal Level 1099 G Forms How Much Do I Have To Pay Based On My Withholding Aving To Invest

I Got Unemployment In Florida How Will My Taxes Be Affected Firstcoastnews Com

You Have To Pay Taxes On Unemployment Checks What You Need To Know

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

State Income Tax Deadline Pushed Back To June Most 2020 Unemployment Benefits Will Be Exempt From Taxes Little Village

Unemployment Benefits Tax Issues Uchelp Org

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Get Ready To Owe Lots In Taxes Over Covid 19 Unemployment Benefits Iheart

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post